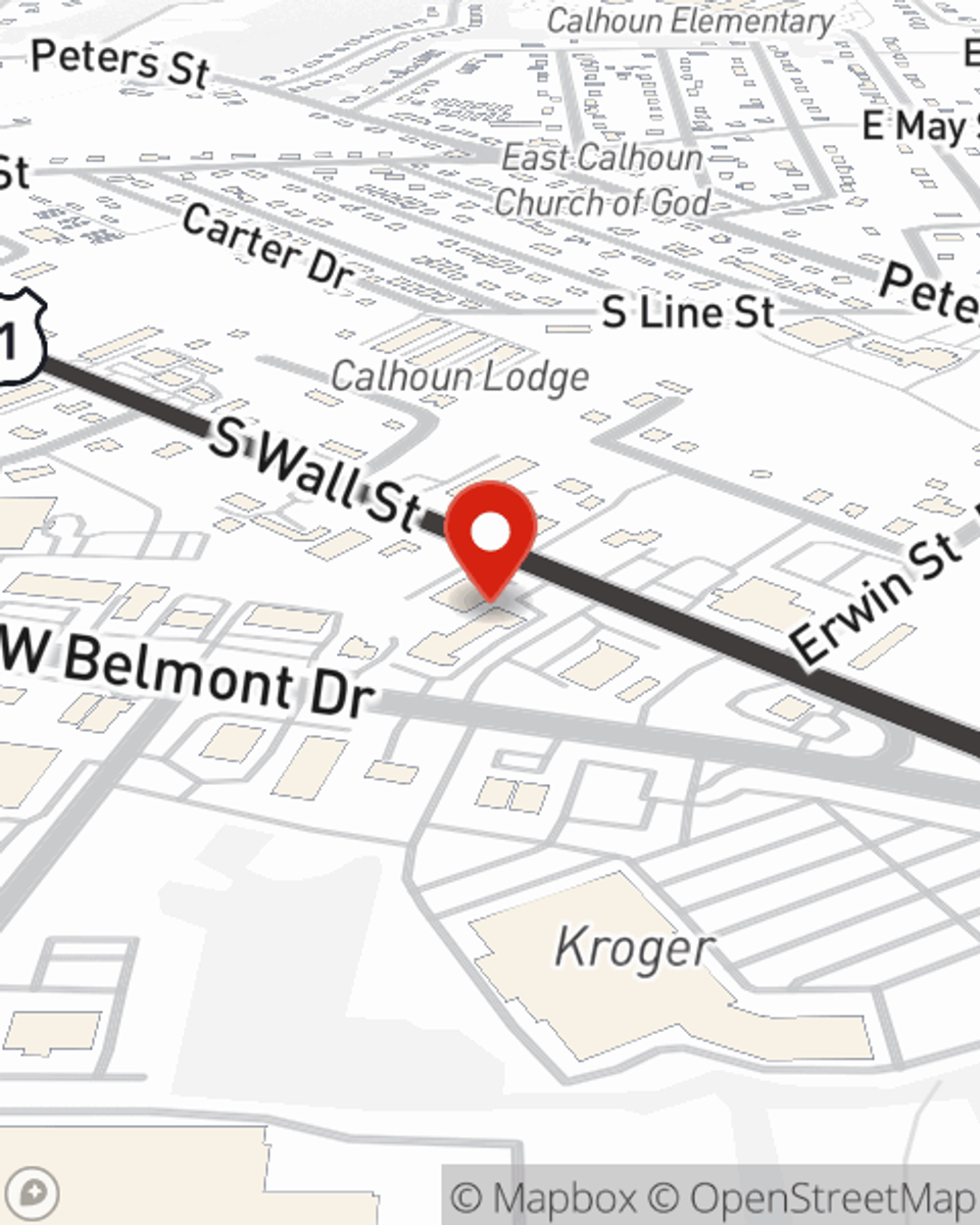

Business Insurance in and around Calhoun

Looking for small business insurance coverage?

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

When experiencing the highs and lows of small business ownership, let State Farm do what they do well and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, errors and omissions liability, and worker's compensation for your employees.

Looking for small business insurance coverage?

This small business insurance is not risky

Keep Your Business Secure

When you've put so much personal interest in a small business like yours, whether it's an ice cream shop, a veterinarian, or a lawn care service, having the right coverage for you is important. As a business owner, as well, State Farm agent Melissa Eldridge understands and is happy to offer exceptional service to fit your business.

Call Melissa Eldridge today, and let's get down to business.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Melissa Eldridge

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.